Blog

How to create a budget?

How to Create a Budget

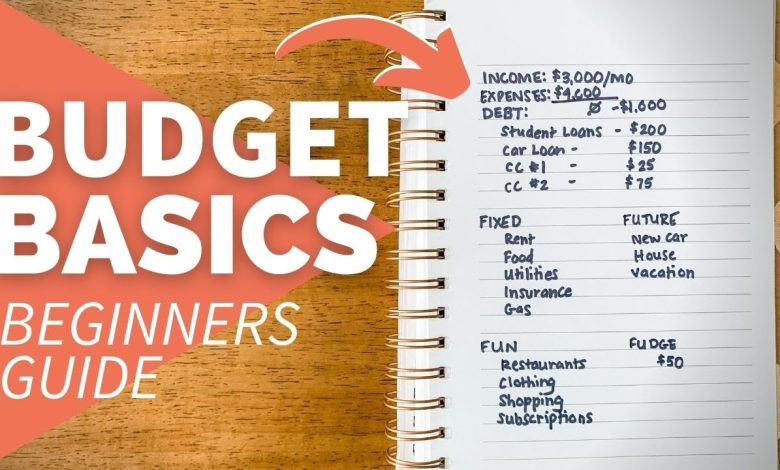

It is important to create a budget for yourself when it comes to managing your finances. A budget will help you maximize your personal wealth and money, helping you to save for the future. By creating and managing a budget, you can easily identify your spending habits and create a plan for how you will distribute your income most effectively.

Steps for Creating a Budget

- Step 1: Gather your financial records including pay stubs, receipts, bills and bank statements.

- Step 2: Analyze your financial records. Divide up your spending into categories and track the average amount that you spend in each category.

- Step 3: Set goals for yourself. Identify where you want to cut back and create savings goals specifically.

- Step 4: Create a plan for how you will distribute your income towards expenses and savings. Identify your needs and wants and determine how much of your income should go towards each.

- Step 5: Create a budgeting system. Utilize technology, like budgeting apps and spreadsheets, to track your spending and budget.

- Step 6: Review your budget regularly. Take a look at it every month, or even every week or day, to make sure that you have the necessary discipline to stay on track.

Tips for Creating and Maintaining Your Budget

- Start small. Many people try to create an incredibly detailed budget, making it more difficult for them to stick with. Start with the basics such as tracking income and expenses first, and work your way to a more detailed budget as you become more comfortable with the process.

- Set realistic expectations. Many people start a budget with a plan to give up the things they love in order to save, but having reasonable expectations for yourself is important. The idea is to become financially aware and to work smarter, not necessarily to give up the things that you enjoy.

- Don’t forget to factor in fun in your budget. Having reasonable, reasonable spending money allows you to have fun and enjoy life without overspending.

- Be honest with yourself. Don’t underestimate your spending habits or inflate your income in order to make your budget look better. Being honest with yourself and knowledge of what your financial situation really is, is the best way to create an accurate and effective budget.

Creating and managing a budget is the first step towards financial success. Having a plan to distribute your income in the most effective way is essential for any person hoping to maximize their personal wealth and money. With the steps above and a dedication to becoming financially aware, you can create an effective budget that best suits your lifestyle.